Akhuwat Agriculture Loan Apply

Akhuwat Foundation, Akhuwat Agriculture Loan Apply a renowned non-profit organization in Pakistan, has been at the forefront of providing interest-free loans to help alleviate poverty and empower the marginalized sectors of society. One of the significant offerings of the foundation is its agriculture loans, designed to support farmers and agricultural entrepreneurs. In this article, we will cover everything you need to know about Akhuwat Agriculture Loans, including how to apply, eligibility criteria, benefits, and repayment options. By the end of this article, you’ll have a complete understanding of how to access these interest-free loans in 2024.

What is Akhuwat Foundation?

Akhuwat Foundation was established in 2001 with a mission to eradicate poverty through interest-free microfinance. The foundation aims to provide financial assistance to underprivileged individuals and families, enabling them to start or expand their businesses, educate their children, or improve their living conditions. With various types of loans such as business, home, and agriculture loans, Akhuwat stands as a beacon of hope for many in Pakistan.

Read More : Breaking News: Understanding the Apni Car Scheme 2024

Why Choose Akhuwat Agriculture Loans?

Agriculture is the backbone of Pakistan’s economy, with a large portion of the population relying on farming for their livelihood. However, many small farmers and agricultural workers face challenges like lack of funds, modern equipment, and access to essential resources. Akhuwat Agriculture Loans offer a lifeline to these farmers by providing interest-free loans, making it easier for them to invest in seeds, fertilizers, machinery, and other essential farming resources.

Akhuwat Agriculture Loan Apply 2024: How to Get Started

If you’re a farmer or someone involved in the agricultural sector, applying for Akhuwat Agriculture Loans in 2024 is a straightforward process. Here’s a step-by-step guide:

1. Visit the Nearest Akhuwat Office

You can find Akhuwat offices in most major cities and towns across Pakistan. If you cannot visit physically, Akhuwat’s official website also offers online services for loan applications.

2. Fill Out the Application Form

Whether applying online or in person, you’ll need to fill out the loan application form. Ensure you provide accurate details, including personal information, contact details, and the type of loan you are seeking.

3. Provide Required Documents

Documents such as your National Identity Card (CNIC), proof of income, land ownership documents (if applicable), and any other relevant information must be submitted.

4. Attend an Interview

After submitting the application, you may be called for an interview with Akhuwat’s loan officers. This is an opportunity for the foundation to understand your needs better and assess your eligibility.

5. Loan Approval

If your application meets the eligibility criteria, the loan will be approved within a few weeks, and the funds will be disbursed.

Read More: Release of 15 Lakh Loans: Apna Chhat Apna Ghar Project

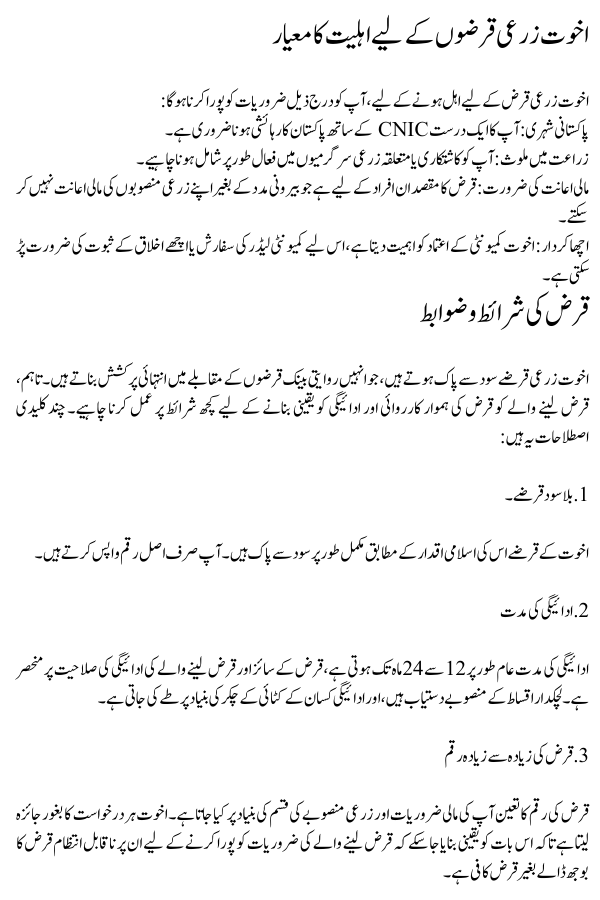

Eligibility Criteria for Akhuwat Agriculture Loans

To qualify for an Akhuwat Agriculture Loan, you must meet the following requirements:

- Pakistani Citizen: You must be a resident of Pakistan with a valid CNIC.

- Involved in Agriculture: You should be actively involved in farming or related agricultural activities.

- Need for Financial Assistance: The loan is aimed at individuals who cannot afford to finance their agricultural projects without external help.

- Good Character: Akhuwat values community trust, so a recommendation from a community leader or evidence of good moral character may be required.

Loan Terms and Conditions

Akhuwat Agriculture Loans are interest-free, which makes them highly attractive compared to conventional bank loans. However, the borrower must adhere to certain conditions to ensure smooth loan processing and repayment. Some of the key terms are:

1. Interest-Free Loans

Akhuwat’s loans are completely free of interest, in line with its Islamic values. You only repay the principal amount.

2. Repayment Period

The repayment period typically ranges from 12 to 24 months, depending on the size of the loan and the borrower’s ability to repay. Flexible installment plans are available, and payments are scheduled based on the farmer’s harvest cycle.

3. Maximum Loan Amount

The loan amount is determined based on your financial needs and the type of agricultural project. Akhuwat carefully assesses each application to ensure the loan is sufficient to meet the borrower’s needs without burdening them with unmanageable debt.

How Akhuwat Agriculture Loans Help Farmers

The impact of Akhuwat Agriculture Loans on Pakistan’s farming community is immense. Here are a few ways these loans benefit farmers:

1. Access to Modern Farming Equipment

Many small farmers cannot afford to buy modern farming machinery like tractors, harvesters, and irrigation systems. Akhuwat loans help bridge this gap by providing funds for purchasing or leasing equipment.

2. Investment in Quality Seeds and Fertilizers

Using high-quality seeds and fertilizers can significantly improve crop yields. However, these items can be expensive. With Akhuwat’s help, farmers can invest in better inputs, ensuring healthier crops and higher profits.

3. Expansion of Farmland

Some farmers have the opportunity to expand their operations but lack the capital to buy more land. Akhuwat’s loans can be used for land acquisition or renting more fields, enabling farmers to grow more crops and increase their income.

4. Sustainability and Long-Term Growth

By offering interest-free loans, Akhuwat promotes sustainable growth in the agriculture sector. Farmers are not burdened with high-interest rates, enabling them to reinvest their profits back into their farms, leading to long-term success.

Success Stories: Real Impact of Akhuwat Agriculture Loans

The Story of Ghulam Rasool from Punjab

Ghulam Rasool, a farmer from a small village in Punjab, struggled for years to make ends meet with his modest 5-acre farm. His lack of access to modern equipment and quality seeds limited his crop production. In 2022, he applied for an Akhuwat Agriculture Loan and received Rs. 100,000. This loan allowed him to purchase a tractor and high-quality seeds. Today, Ghulam Rasool’s farm yields have tripled, and his income has increased, providing him with a better quality of life for his family.

The Journey of Amina from Sindh

Amina, a widow from Sindh, took out an Akhuwat Agriculture Loan in 2023 to invest in organic farming. With Rs. 75,000, she was able to buy organic seeds and fertilizers. Her organic vegetables are now in high demand in local markets, and she has not only repaid the loan but also expanded her farm by leasing additional land.

Challenges Faced by Farmers and How Akhuwat Loans Address Them

Farmers in Pakistan face various challenges, such as:

- Lack of Capital: Most small-scale farmers do not have the funds needed to invest in better seeds, fertilizers, or equipment.

- Debt Trap: Farmers often fall into a cycle of debt when they borrow from conventional money lenders who charge high-interest rates.

- Market Fluctuations: Price volatility in agricultural markets can make it difficult for farmers to make a consistent income.

Akhuwat Agriculture Loans help tackle these issues by providing interest-free financial assistance, offering flexible repayment plans, and promoting sustainable farming practices.

How to Repay Akhuwat Agriculture Loan Apply

Repaying Akhuwat Agriculture Loans is simple and stress-free. Borrowers can make payments in easy installments according to their income and harvest schedules. Akhuwat encourages borrowers to repay on time to maintain the cycle of loan disbursement, allowing other farmers to benefit from the foundation’s assistance.

Payment Methods

You can repay your loan via:

- Direct bank deposit to Akhuwat’s designated account.

- Cash payments at Akhuwat offices.

- Mobile banking solutions for remote or rural areas.

اخوت کے زرعی قرضوں کی ادائیگی کیسے کی جائے۔

اخوت کے زرعی قرضوں کی ادائیگی آسان اور دباؤ سے پاک ہے۔ قرض لینے والے اپنی آمدنی اور کٹائی کے شیڈول کے مطابق آسان اقساط میں ادائیگی کر سکتے ہیں۔ اخوت قرض دہندگان کی حوصلہ افزائی کرتا ہے کہ وہ قرض کی تقسیم کے چکر کو برقرار رکھنے کے لیے وقت پر ادائیگی کریں، جس سے دوسرے کسانوں کو فاؤنڈیشن کی امداد سے فائدہ اٹھانے کی اجازت دی جائے۔

ادائیگی کے طریقے

آپ اپنا قرض اس کے ذریعے ادا کر سکتے ہیں

اخوت کے نامزد اکاؤنٹ میں براہ راست بینک ڈپازٹ۔

اخوت کے دفاتر میں نقد ادائیگی۔

دور دراز یا دیہی علاقوں کے لیے موبائل بینکنگ کے حل۔

Read More : Breaking News: Prime Minister Youth Program: Empowering Pakistan’s Youth

Conclusion

Akhuwat Agriculture Loan Apply offer a life-changing opportunity for small-scale farmers in Pakistan, empowering them to improve their agricultural productivity and secure a better future. The loans are accessible, interest-free, and come with flexible repayment options, making them a perfect choice for farmers in need of financial assistance. If you’re involved in agriculture and looking for a way to boost your farm’s productivity, consider applying for Akhuwat’s Agriculture Loans in 2024.